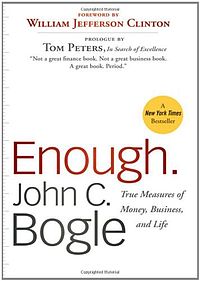

Enough 下载 pdf 电子版 epub 免费 txt 2025

Enough电子书下载地址

内容简介:

John Bogle puts our obsession with financial success in perspective Throughout his legendary career, John C. Bogle-founder of the Vanguard Mutual Fund Group and creator of the first index mutual fund-has helped investors build wealth the right way and led a tireless campaign to restore common sense to the investment world. Along the way, he's seen how destructive an obsession with financial success can be. Now, with Enough. , he puts this dilemma in perspective. Inspired in large measure by the hundreds of lectures Bogle has delivered to professional groups and college students in recent years, Enough. seeks, paraphrasing Kurt Vonnegut, "to poison our minds with a little humanity." Page by page, Bogle thoughtfully considers what "enough" actually means as it relates to money, business, and life. Reveals Bogle's unparalleled insights on money and what we should consider as the true treasures in our lives Details the values we should emulate in our business and professional callings Contains thought-provoking life lessons regarding our individual roles in society Written in a straightforward and accessible style, this unique book examines what it truly means to have "enough" in world increasingly focused on status and score-keeping.

书籍目录:

暂无相关目录,正在全力查找中!

作者介绍:

暂无相关内容,正在全力查找中

出版社信息:

暂无出版社相关信息,正在全力查找中!

书籍摘录:

暂无相关书籍摘录,正在全力查找中!

在线阅读/听书/购买/PDF下载地址:

原文赏析:

暂无原文赏析,正在全力查找中!

其它内容:

书籍介绍

John Bogle puts our obsession with financial success in perspective Throughout his legendary career, John C. Bogle-founder of the Vanguard Mutual Fund Group and creator of the first index mutual fund-has helped investors build wealth the right way and led a tireless campaign to restore common sense to the investment world. Along the way, he's seen how destructive an obsession with financial success can be. Now, with Enough. , he puts this dilemma in perspective. Inspired in large measure by the hundreds of lectures Bogle has delivered to professional groups and college students in recent years, Enough. seeks, paraphrasing Kurt Vonnegut, "to poison our minds with a little humanity." Page by page, Bogle thoughtfully considers what "enough" actually means as it relates to money, business, and life. Reveals Bogle's unparalleled insights on money and what we should consider as the true treasures in our lives Details the values we should emulate in our business and professional callings Contains thought-provoking life lessons regarding our individual roles in society Written in a straightforward and accessible style, this unique book examines what it truly means to have "enough" in world increasingly focused on status and score-keeping.

精彩短评:

作者:丁 发布时间:2018-12-25 09:15:02

john bogle offered many insightful advices and observations in terms of life value and business practices

作者:rtt322 发布时间:2019-05-17 22:30:14

Success is not

the key to happiness. Happiness is the key to success.

作者:shui422 发布时间:2015-10-14 10:25:57

原版引进的就是好

作者:yihan爱书橱 发布时间:2012-09-14 19:23:35

好荣幸成为豆瓣上第一个点“读过”的读者。这本书出自叱咤共同基金界的传奇人物John Bogle, Vanguard Index Fund的创始人。他对生活、事业、追求的睿智思考给了我很大启发。书评 http://book.douban.com/review/5584248/。

作者:偶尔喜欢吃鱼 发布时间:2018-11-26 23:06:15

又是一本现在看了吸收不进的书。不过实践家写的鸡汤,即使理解不了,也会想想他是经历了什么才讲出这样的鸡汤。

印象最深的是博格从整体的角度看问题,不用复杂计算就可以讲清楚。CEO as a group薪资涨幅远远高于他们所管理的公司的收入利润的增幅。speculation as a group本来是零和游戏,又要给金融机构手续费用,所以是负的游戏。speculation as a group没有所谓的timing。simple but inspiring

“I’ve got something he can never have.”

“What on earth could that be?"

“The knowledge that I’ve got enough"

作者:一橙YC 发布时间:2019-12-20 22:25:25

靠谱。想到一个人跟我说,你虽然没少看书,但是都没落到实处。以及另一个人说,你以后再看这本书,会发现其中的坑你还是踩了。

深度书评:

Earn a living and fight the battle

作者:Shermanizer 发布时间:2019-01-27 11:22:41

Earn a living and fight the battle

Enough

1/26/2019

2018年末到2019年初的这段时间一直在读Mr. Money Mustache的博客。在一篇文章里看到了对这本书的推荐,第一次看到Jack Bogel这个名字和founder of Vanguard的头衔。刚上手几天,打开Vanguard网站就看到老先生辞世的消息,感慨闻道太晚。这本书并不长,读起来比较快,也并不生涩乏味,学到了一些投资的概念,加深了long-term investing的理念,也带着赞赏和见贤思齐地心态旁观了老先生老派的人格作风。

这本书让我真正意识到investment(投资)和speculation(投机)的区别。中文的翻译非常好,可惜在英文语境下似乎有将investment做广义用、涵盖两者的现象,之前的我不能看透。比如Kiplinger文章建议invest in黄金或石油用来diversify portfolio,但Bogle的书透彻地点出它只是一种speculation,不创造价值,与长期持有stock(或bond)投资于上市公司的investment有本质的不同。

Bogle回顾了在他职业早期创立Vanguard as the only "mutual" mutal fund company的历史,能通过他的文字描述“一睹”当时index fund横空出世的历史,让人感叹确实是普通投资者之幸。

Bogle的行文非常流畅,引经据典也非常powerful,还时不时穿插点儿智慧狡黠的老人的自曝和幽默。我喜欢他提到的诸多闪光的点:决定这本书名的"I have enough"的隐喻,不要好高骛远要专注开采自己脚下的人生diamond field的隐喻,以及提到爱因斯坦的“Not all that counts can be counted, and not all that can be counted counts”的诙谐的深刻。

行将而立,在这个节点上,承上启下,感触颇多,犹豫拔剑,剑身生锈,兵器架上也没有其他擅长的武器... 心极茫然。看这本书,是有帮助。

书摘

two characteristics that someone once attributed to me: “the stubbornness of an idealist and the soul of a street fighter.”

The idea was simple. Why should our mutual funds retain an outside company to manage their affairs—the modus operandi (也就是MO) of our industry then and now—when they could manage themselves and save a small fortune in fees? They could be truly mutual mutual funds.

suggested by the research I had done for my senior thesis, and in which I had written, mutual funds “can make no claim to superiority over the market averages.” Before 1975 had ended, we had formed the world’s first index mutual fund. - 1975年,first index fund的诞生

I honor and love you: but why do you who are citizens of this great and mighty nation care so much about laying up the greatest amount of money and honor and reputation, and so little about wisdom and truth and the greatest improvement of the soul?

The investor feeds at the bottom of what is today the tremendously costly food chain of investing. - 羊毛出在羊身上

Investing is all about the long-term ownership of businesses... Speculation is precisely the opposite. It is all about the short-term trading, not long-term holding, of financial instruments—pieces of paper, not businesses—largely focused on the belief that their prices, as distinct from their intrinsic values, will rise; ... First principles:

Commodities have no internal rate of return. Their prices are based entirely on supply and demand.That is why they are considered speculations, and rank speculations at that.

Contrarily, the prices of stocks and bonds are ultimately justified only by their internal rate of return—composed, respectively, of dividends and earnings growth and by interest coupons.That is why stocks and bonds are considered investments. - investing与speculation之分

Most of the decisions in life motivated by greed have unhappy outcomes. - 总结得精辟

the time-honored wisdom of

Occam’s razor

, set forth by the fourteenth-century philosopher and friar William of Occam, has stood me in good stead:

When confronted with multiple solutions to a problem, choose the simplest one.

- 奥卡姆剃刀原理

privatize the substantial rewards earned in mortgage lending (their shareholders made billions; their executives received fortunes in compensation), at the same time as we socialize the risks (the taxpayers pick up the tab). - 书里比较简短地提到了2008房地产泡沫崩盘、联邦政府出手救市的事情,但这个点评非常有力:系统从来就不公平反映在rewards和risk分配上

we know (within a reasonably narrow tolerance) what returns to expect from simple, broadly diversified portfolios of stocks and bonds over the next decade

(likely 7 and 5 percent, respectively).

So we have no choice but to rely on reasonable expectations, formed on the basis of the known sources of stock returns (the initial dividend yield plus the subsequent rate of earnings growth) and bond returns (the initial interest rate). -

普通投资者的best bet

While this so-called index method of value investing has been presented as some sort of Copernican revolution, the idea behind the methodology is many decades old. But offering such funds in ETF form suggests that they are useful for short-term trading—a dubious proposition on the face of it.

Much of this merger activity has reached the level of absurdity. Michael Kinsley, writing in the New York Times in May 2007, notes that in 1946, Warren Avis had an idea. He founded Avis Airlines Rent-a-Car. Two years later Avis sold the company to another businessman, who sold it to a company called Amoskeag, which sold it to Lazard Freres, which sold it to giant conglomerate ITT Corporation (all this by 1965!). All told, Avis has gone through some 18 different ownerships, and each time, Kinsley notes,

“there have been fees for bankers and fees for lawyers, bonuses for top executives [to pay them off for the past or to sign them on for the future], and theories about why this was exactly what the company needed.”

Since then (it’s a long story), Avis has been publicly held again, then conglomerate-owned again (Norton Simon, Esmark, Beatrice Foods); then sold to Wesray Capital, which sold half of the business to PHH Group, with the remainder sold to Avis employees, who sold it to a firm called HFS Corporation, which took it public, after which Avis bought, yes, PHH; the combined company was then bought by Cendant. Whew! - 这个Avis的例子特别有意思,M&A本身不创造价值,但是这几经交接确着实让很多人从中受益,并且还有冠冕堂皇的BS "about why this was exactly what the company needed"

Kinsley sums it up well: “Modern capitalism has two parts: there’s business, and there’s finance. Business is renting you a car at the airport. Finance is something else.”

Vanguard’s market share, as I’ve said countless times,

must be a measure, not an objective; it must be earned, not bought. - 这是看待很多事情(数字比分)的态度

In part responding to this change, the behavior of investors who own mutual funds has also changed. Fund investors no longer just pick funds and hold them. They trade them. In 1951, the average fund investor held his or her shares for about 16 years. Today, that holding period averages about four years.To make matters worse, fund investors don’t trade very successfully. Because they usually chase good performance and then abandon ship after bad performance, the asset-weighted returns—those actually earned by fund investors —have trailed the time-weighted returns reported by the funds themselves by the astonishing gap mentioned previously, in which the 10 percent annual return of the average fund over 25 years was 37 percent higher than the 7.3 percent return earned by fund shareholders. - Mutual fund这么些年,难免有些已经开始有些变味了,谨慎

helping investors to make the uncertain but necessary judgments to determine their allocation between stocks, with their opportunity for growth of capital and the attendant risks, and bonds, with their income productivity and relative stability, and then doing everything in our power to diversify these investments and minimize the costs—management fees, operating costs, marketing expenses, turnover impact—promising only to give investors their fair share of financial market returns: no more, no less. - personal finance professional应有的职业操守

these words from President Calvin Coolidge: N

othing in the world can take the place of persistence. Talent will not;nothing is more common than unsuccessful men with talent. Genius will not; unrewarded genius is almost a proverb. Education will not; the world is full of educated derelicts. Persistence and determination alone are omnipotent.

The slogan “Press on” has solved, and always will solve, the problems of the human race.

It has a radical philosophy and self-image. The company’s unconventional thinking about its dream is [often] born of a liberating vision. Why are liberating visions so rare? Because a powerful liberating vision is difficult to deliver. That difficulty of delivery, however, is only half of the answer.The other half is that so few who have the gift for summarizing a vision, and the power to articulate it persuasively, have the urge and the courage to try. - 让我想到MMM的博客,for this I applaud his efforts... 他让我和千千万万其他的读者擦亮了双眼看到了early retirement之路,但哪怕我有时都会质疑他(出于妒嫉、不理解、心底的不信任、cynicism?),所以可想他写博客的灵光、坚持和brilliant delivery of the liberating visions的不容易

Two and a half thousand years ago, the Greek philosopher Protagoras told us that “man is the measure of all things.” Today, I fear, we are becoming a society in which “things are the measure of the man.”

Indeed, there’s a perhaps tongue-in-cheek aphorism that

whoever dies with the most toys wins. Such a measure is absurd; it is superficial; and, finally, it is self-defeating. The world has far too many calls on its limited resources to expend them on things trivial and things

transitory. There are literally billions of human beings out there, all over the globe, who cry out for support and for salvation, for security and for compassion, for education and for opportunity—those intangibles that carry a value far in excess of so many tangible things whose nature is, finally, inconsequential. - This is very very powerful.

as what you have may come and go, who you are—your character—will endure.

What are the characteristics by which we should measure our lives? Surely the nineteenth-century German philosopher Goethe identified one of them: boldness. Are you in earnest? Seize this very minute; What you can do, or dream you can do, begin it; Boldness has genius, power and magic in it.

Even today, Dr. Franklin’s idealistic eighteenth-century version of entrepreneurship is inspirational.When he reminded us that “energy and persistence conquer all things,” Franklin was likely describing his own

motivations to create and to succeed,

using Schumpeter’s formulation,

for the joy of creating, of exercising one’s energy and ingenuity, the will to conquer, and the joy of a good battle.

“I long to accomplish a great and noble task,” the ever-inspiring Helen Keller once wrote,“but it is my chief duty to accomplish humble tasks as though they were great and noble. The world is moved along, not only by the mighty shoves of its heroes, but also by the aggregate of the tiny pushes of each honest worker.”

And, even in today’s turbulent markets, I do my best to avoid the temptation to peek at the value of my fund holdings. (A good rule for all of us!)

我是我所见的一部分——《Enough》书评

作者:yihan爱书橱 发布时间:2012-09-14 22:58:37

“I am part of all that I have met.” 这句话已是我两周内第二次读到了。这次是在《Enough》这本书里读到的,上一次则是在Jacqueline的《The Blue Sweater》中。原句出自《尤利西斯》,这句话引起了我巨大的共鸣,几乎就要成为我的座右铭了。一个人看到什么取决于他去过哪里,而一个人成为什么样的人也取决于他读过的书和经历过的事。也正因为此,我觉得我成了我所阅读过的一部分,所以我决定以后每看一本书就写一篇书评,因为这些书让我之所以为我,让我成为了更好的自己。

我是在PageOne里发现《Enough》这本书的,没想到小小一本书里蕴含了巨大的智慧宝藏。这也是我永远爱实体书屋的原因之一,与好书不期而遇的感觉太棒了!

当时我正在商业区搜寻伟大投资家的智慧,无意间发现了这边标题如此简洁直穿人心的书。一看作者John C. Bogle,是世界上第一个指数基金Vanguard Mutual Fund的创始人,再一看副标题——true measures of money, business, and life——我立即被吸引了!据Bogle说,写这本书的灵感来自纽约时报的一则小故事,大意是一位作家去一小岛上参加一个亿万富翁的晚会,席间有人问作家,富翁昨天一天赚的钱就抵得上您最富盛名的小说一辈子的销量了,你作何感想?作家答,但我有一样富翁没有的东西。问,什么?答,the knowledge that I've got enough。

Bogle在96年做了心脏移植手术,而他是05年读到这个故事的。重获新生的他对人生的意义有了更深的感悟,也让他对生活的细节更加敏感。Enough这个只有6个字母长的单词引发了Bogle许多思考,他想,这实际上是个多么奢侈的词!他想到了现代社会泛滥的,稀缺的,这个词让Bogle迫切的希望在他在世不多的日子里,告诉我们什么是真正重要的,什么是我们要追求的。这本书的每一页都充满真诚,Bogle似乎想把几十载的成功的学业事业和婚姻中总结出的人生真谛都摊开在读者面前。我读得很感动,但书评要是面面俱到就没意思了。所以就谈几点我感触最深的吧。

首先是他求学生涯中给他巨大启发的一个小故事——一望无际的钻石地。故事说的是在波斯王国一个富有的农民为了变得更为富有跋山涉水费尽心机地去寻觅钻石地,结果确实寻寻觅觅、冷冷清清、凄凄惨惨戚戚,客死他乡。他没有料到的是,这位农民故乡家中的新主人,却在一次垦地中发现了一粒金光闪闪的钻石,而这之后成了远近闻名的——Colconda钻石田。这个故事就跟寓言“青鸟”一样,告诉我们,宝藏常常就在我们身边。所以,Bogle坚信机会不是四处奔波寻找出来的,而是源于日常生活中,只要他尽心做好手头的事,就能不断发现宝藏。就这样,他一步步从好好念书开始,一路从普林斯顿大学到惠灵顿投资公司,最后成立了Vanguard基金。他并没有一开始就把触手伸向遥不可及的地方,而是善于利用身边的资源。

这个故事我也深有共鸣。对于我个人而言,许多资源都已足够,只是我过去常常朝三暮四,沉溺在资料收集癖中无法自拔。我会下载堆积如山的书,在豆瓣上不断不断的勾选“想看”、“想读”,报名了一节又一节的公开课,却忽略了最重要的资料常常近在咫尺。而我如果能好好利用手头的资源,就已经可以学得兼具深度和广度了。所以,近段时间加上看完了《the power of less》, 我也已开始不断甄别哪些是重要的,让最重要的东西永远能一目了然,而不是沉溺在一堆无穷尽的资料库中。

Bogle营造的企业氛围也是我钦佩不已的,在谈到何以早就伟大的企业时,他居然用用一句话就能总结:maintaining an attractive, efficient work environment; providing a meaningful communication program; and paying fair compensation. 而在第六章“Too much management, not enough leadership” 中,Bogle用十个他一贯秉承的原则来具体展开了这句话,让我惊叹。也许,这些准则就是让Vanguard能从 good 走向 great 的动力。 因为本章是此书给我收获最大的部分之一,所以我想把这是个准则写出来,分享给现在的你们,也给将来的自己:

1.Make caring the soul of the organization

让人与人之间建立起关爱,信任。让每一个人都切切实实的感到被关心。

2.Forget about employees

Bogle不喜欢employee这个词,因为这个词隐示了赤裸裸的剥削与被剥削的关系。他更喜欢用crew member,这样就有一种宠辱与共,同舟共济的团结的感觉。

3.Set high standards and values——and stick to them

4.Talk the talk. Repeat the values endlessly

5.Walk the walk. Actions speak louder than words.

Bogle认为以身作则是再重要不过的了,时常在办公室走动,让“船员”切身感到领导的存在,便是很好的领导方式。

6.Don't overmanage

不要过分细化评估标准,因为很多东西是无法衡量的。同事关系,责任心,上进心,微笑的上班等等这些跟工作有关的东西,个人的东西,是冷冰冰的业绩评估表所无法反映的。

7.Recognize individual achievement

Bogle每年都给“船员”们发各种单项奖,全由大家共同评出。这对“船员”们来说既是物质鼓励也是精神鼓励。

8.A reminder——Loyalty is a two-way street

企业都希望员工忠诚,可企业对员工又是如何呢?Bogle在这一点是可以很自豪,因为公司自上到下,连清洁工都有股权,而且公司的所有利润都是与大家一起分享的,而且老员工还能逐年获得加薪。荣辱与共才能培养忠诚度!

9.Lead and manage for the long term

短视是很多领导的通病,而因为领导任期的原因,这点更加暴露无遗。Vanguard公司因为其对员工的忠诚,吸引了很多忠诚的员工,这些员工有一种主人翁的感觉,自然能把企业长远利益放在更重要的位置上。

10. Press on, regardless

最后,我还想再说一句给我很大触动的话——"For unto whomever much is given, of him much shall be required.", 或者简单点说,for whom much is given, much is expected. 这也是我对自己的要求,回想自己的经历,我无比感激耶和华恩赐给我的一切。诚然,我也知道,我的才华,我的机会并不仅仅属于我一个人。正如本杰明·富兰克林所说:"knowledge is not the personal property of its discoverer, but the common property of all." 我得到如此多幸运的眷顾,但这些幸运其实不只是属于我一个人。早晚,我一定会找到一条路,让我能最大程度地回馈这个世界。

谢谢Bogle,谢谢《Enough》这本书!

网站评分

书籍多样性:6分

书籍信息完全性:8分

网站更新速度:5分

使用便利性:6分

书籍清晰度:7分

书籍格式兼容性:4分

是否包含广告:5分

加载速度:5分

安全性:5分

稳定性:5分

搜索功能:3分

下载便捷性:4分

下载点评

- 藏书馆(629+)

- 值得下载(151+)

- 无颠倒(406+)

- 赚了(201+)

- 内容完整(256+)

- 种类多(241+)

下载评价

- 网友 印***文: ( 2024-12-28 10:35:16 )

我很喜欢这种风格样式。

- 网友 常***翠: ( 2025-01-04 17:56:36 )

哈哈哈哈哈哈

- 网友 芮***枫: ( 2024-12-21 10:31:13 )

有点意思的网站,赞一个真心好好好 哈哈

- 网友 家***丝: ( 2024-12-31 00:15:27 )

好6666666

- 网友 马***偲: ( 2024-12-12 01:58:14 )

好 很好 非常好 无比的好 史上最好的

- 网友 田***珊: ( 2024-12-22 17:47:04 )

可以就是有些书搜不到

- 网友 通***蕊: ( 2025-01-08 21:12:32 )

五颗星、五颗星,大赞还觉得不错!~~

- 网友 晏***媛: ( 2025-01-02 05:55:43 )

够人性化!

- 网友 车***波: ( 2025-01-02 10:44:56 )

很好,下载出来的内容没有乱码。

- 网友 寇***音: ( 2025-01-01 04:31:37 )

好,真的挺使用的!

- 网友 林***艳: ( 2025-01-02 23:13:23 )

很好,能找到很多平常找不到的书。

- 进入WTO的中国涉外经济法律制度 孙南申 等著 人民法院出版社,【正版保证】 下载 pdf 电子版 epub 免费 txt 2025

- 走近陶行知 下载 pdf 电子版 epub 免费 txt 2025

- 在创意经济高地上舞蹈 下载 pdf 电子版 epub 免费 txt 2025

- 亲爱的小鱼 下载 pdf 电子版 epub 免费 txt 2025

- 狼行天下 下载 pdf 电子版 epub 免费 txt 2025

- 合同法学 四川大学出版社 9787569010800【正版新书】 下载 pdf 电子版 epub 免费 txt 2025

- 中国神童对联 下载 pdf 电子版 epub 免费 txt 2025

- 权力制约与反腐倡廉 下载 pdf 电子版 epub 免费 txt 2025

- 好新闻的诞生:人民日报夜班编辑这样改稿 下载 pdf 电子版 epub 免费 txt 2025

- 中央音乐学院海内外考级曲目·筝1-6级/中央音乐学院校外音乐水平考级丛书 下载 pdf 电子版 epub 免费 txt 2025

书籍真实打分

故事情节:9分

人物塑造:8分

主题深度:5分

文字风格:7分

语言运用:3分

文笔流畅:5分

思想传递:8分

知识深度:4分

知识广度:4分

实用性:8分

章节划分:8分

结构布局:7分

新颖与独特:6分

情感共鸣:4分

引人入胜:6分

现实相关:5分

沉浸感:9分

事实准确性:8分

文化贡献:5分